We often heard the word market and imagine a Persian market full of people offering all kinds of products. In a sense this encompasses what the market is about, but “the market” as an economic term is more abstract and meaningful.

What is the market? the market is one of the institutions, systems, and social relations whereby economic agents engage in exchange. The market is the physical or virtual place where buyers and sellers meet to trade. Even though it is possible to exchange goods and services through barter, in most markets the parties use money as a means of exchange.

Through the market, demand and supply establish the prices of the goods and services of the economy. However, this equilibrium depends highly on the market structure and can be altered by market failures or external agents like the government.

Financial market

The financial market is the place, system, or mechanism whereby parties buy or sell financial assets. It can be physical or virtual, but its end goal is the same; to facilitate the exchange between buyers and sellers and determine the prices of the financial assets.

- Stock market: individuals and organizations trade stocks.

- Commodity markets: trading of goods from the primary economic sector like coffee, rice, oil, or gold.

- Bond markets: based on the issue of debt, or the buying and selling of debt securities.

Labor market

This exchange determines wages, employment, and incomes. Macroeconomics study this market through variables like participation rate, unemployment and employment rate, and labor force. While microeconomics focuses on the maximization of profits (firms) and utility (workers).

Goods and services market

Some examples of goods and services market are supermarkets, farmers’ markets, hairdressing, restaurants or even internet markets (e-commerce).

Types of market structures

Perfect competition

Furthermore, in this type of market, there is a large number of firms and consumers. Sellers are obligated to sell at an equilibrium price otherwise they would lose sales to its competition. Businesses are price-taker, so they can’t influence the market price.

This conception is mostly theoretical because, in reality, it is almost impossible to meet the necessary characteristics to have perfect competition. Probably the best example of a market with the perfect competition is the stock market.

Monopolistic competition

This type of market is common among products manufactured by big companies with powerful brands, like the market of cars, computers, TVs, or cereals. One example of monopolist competition is the market of smartphones. In this market, Apple offers the iPhone (only Apple sells the iPhone). This makes Apple a monopoly in the market for iPhones, but the iPhone is offered in a market with substitutes hence Apple has to compete with other producers.

Compared with the Oligopoly, the monopolist competition is more competitive as a consequence of a larger number of companies in the market.

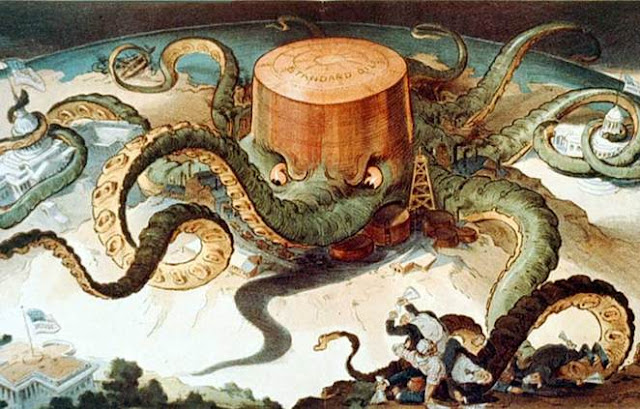

Monopoly

Buyers in this type of market are in a disadvantage because they must adapt to the quantity, quality, and price offered by the monopoly.

Barriers to entry prevent new competitors from entering the market, some of the examples are:

- Public policies: e.g., patents

- Exclusive property of certain factors of production: e.g., gem mines

- Natural monopoly: economies of scale cause efficiency to increase continuously with the size of the firm. e.g., metro systems.

- Market strategies: e.g., dumping

Oligopoly

The oligopoly is similar to a monopoly, but instead of only one producer, there is a handful of producers. This results in limited competition. Even though oligopolists don’t have the same pricing power as monopolists, it is possible for them to collude and set higher prices.

Monopsony

Contrary to monopoly, in the monopsony, there are multiple sellers but only one buyer. The buyer has significant power to determine the prices of the market.

An example of a monopsony is a banana trader that buys all the products of the region or country.

Market barriers and globalization

In the last two centuries, the geographical scope of markets has increased dramatically thanks to technological developments in transport which have reduced transport costs.

This expansion benefits consumers as it increases competition among firms and reduces prices. An example of this is local libraries: 20-30 years ago in many towns, it was common that only one library sold books. Nowadays thanks to the Internet people can buy any book, digital or paperback from anywhere and cheaper.

Black markets

The black market is where illegal goods and services are traded. Due to its illegal nature, it operates outside the formal economy.

The most common causes of black markets are smuggling, high taxes, price controls, and quality and quantity restrictions. Some examples of black markets are illegal drugs, exotic animals, prostitutes, and forced labor.

Main source:

Econlib

Leave a Reply